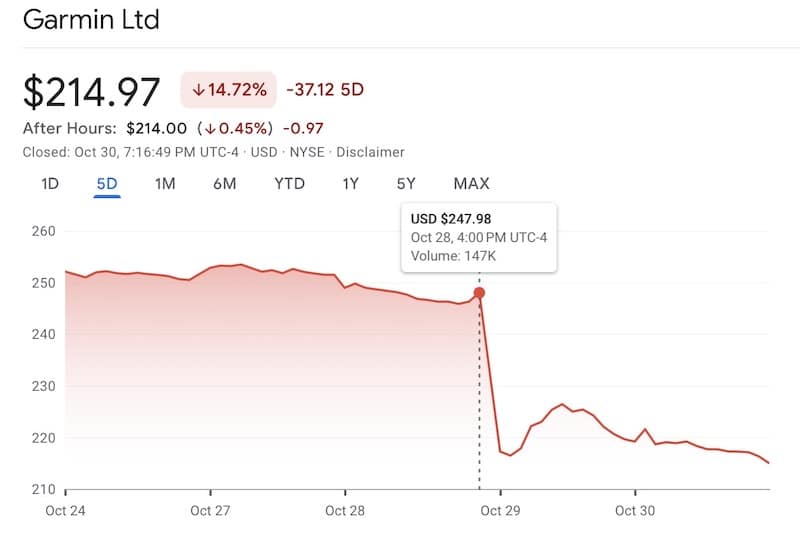

Fenix timing knocks $6.3 billion in value off Garmin in three days

Garmin just posted record revenue and raised its full-year earnings forecast. But the market didn’t like the cut to growth expectations for its Fenix line. The result? The company lost $6.3 billion in market value in just three days, with the stock dropping from $247.98 to $214.92.

Fitness wearables are driving the numbers

The fitness segment brought in $601 million this quarter, up 30 percent year-on-year. Garmin says that’s due to strong demand for its more advanced wearables. They didn’t name specific models, but the company highlighted the launch of the Edge 550 and 850 cycling computers during the quarter. It also mentioned the Bounce 2 smartwatch for kids, which now offers voice calling, messaging and geofencing.

The Venu 4 got a shoutout too. It’s aimed more at lifestyle users, with a new all-metal design, a flashlight and expanded health features. Garmin said the majority of people registering these devices are new to the platform.

Adventure watches lose momentum after last year’s Fenix spike

According to the earnings call transcript, the problem area was what Garmin calls its outdoor segment, which includes the Fenix lineup. That part of the business dropped 5 percent year-on-year, landing at $498 million. Last year’s Fenix 8 launch caused a spike in sales, and this year’s Fenix 8 Pro didn’t land early enough in Q3 to keep the numbers up.

The Fenix 8 Pro adds satellite and cellular support, live tracking, SO, and a microLED display – a first for Garmin wearables. But timing matters. Garmin admitted the product launched too late in the quarter to close the gap left by last year’s surge. They’ve now trimmed full-year growth expectations for the segment to just 3 percent.

Essential reading: Top fitness trackers and health gadgets

That single adjustment was enough to rattle investors and trigger a two-day, $6.3 billion drop in the company’s value.

Strong elsewhere, but the focus is on flagship watches

Marine and aviation are still going strong. Aviation grew 18 percent, with sales from both OEM and aftermarket. Marine jumped 20 percent, with growth across chartplotters, audio and cartography. Garmin even launched a wellness system for horses called Blaze during the quarter. However, it’s clearly early days for that one.

Overall, the company generated $457 million in operating income, had $425 million in free cash flow and now holds $3.9 billion in cash and marketable securities. It also raised full-year EPS guidance to $8.15.

But none of that stopped the selloff. The market reaction shows just how closely Garmin’s valuation is tied to the Fenix and other high-end watch cycles.

Garmin says channel inventory is lean and well-positioned for Q4. The Fenix 8 Pro could still deliver, but it will need to make up for lost time during the holiday quarter.

Subscribe to our monthly newsletter! Check out our YouTube channel.

And of course, you can follow Gadgets & Wearables on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds.